Staying On Track Amid The Ukraine And Inflation Crises

Published Friday, May 13, 2022 at: 6:45 PM EDT

Despite a gain of +2.4% on Friday, the Standard & Poor’s 500 stock index declined for a sixth consecutive week – reportedly the longest losing streak since 2011.

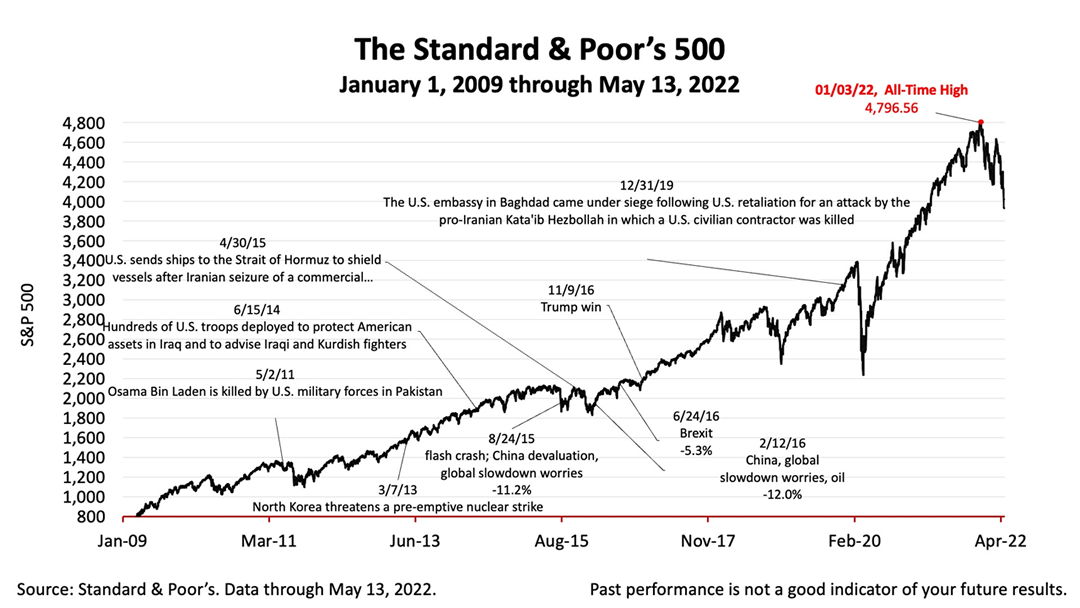

With stocks flirting with bear market territory – a loss of -20% from the last peak on January 3, 2022 – no one can say for certain when the financial and economic outlook will improve. Predicting the future is impossible. However, we do know how difficult times like these have worked out in the not-so-distant past.

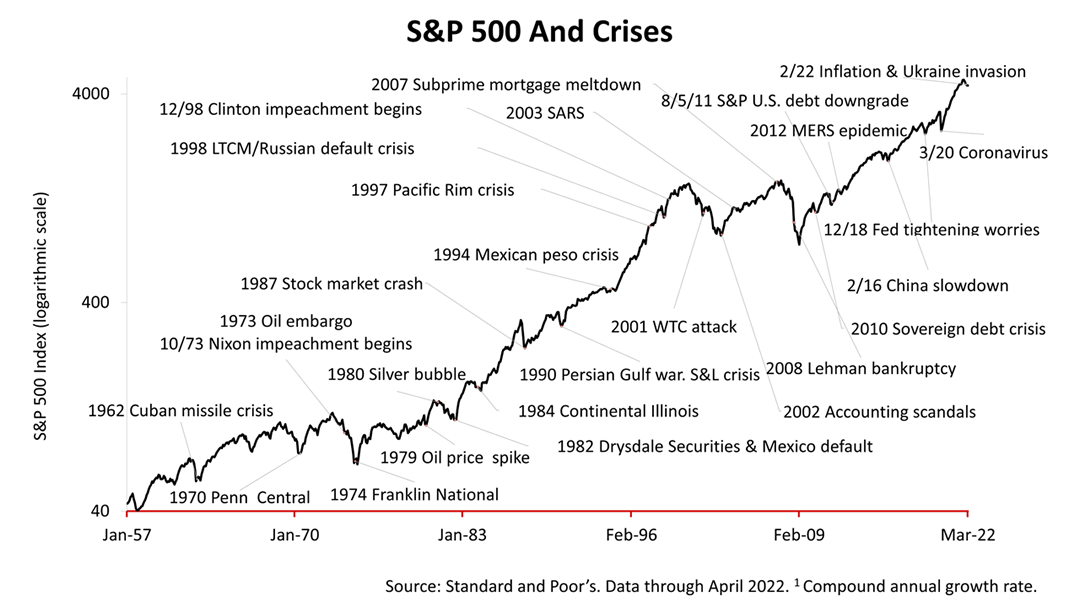

The twin crises of 2022, inflation and Ukraine, pose difficult problems with no quick fixes in sight. Today’s headlines about the war and economy were grim headlines. However, the 27 crises identified shown in this chart dating back to 1957, all came and went. Although they too posed daunting problems with no ready solution, the world’s largest economy continued to prospect and American company stocks soared.

Between February 5 and March 23, 2020, the Covid bear market erased -33.9% of the value of the Standard & Poor’s 500. On March 23, 2020, no one knew the bear market was over. No one knew Covid vaccines would be developed rapidly or that the stock market would appreciate by 71% over the following 21 months.

The Standard & Poor’s 500 stock index closed this Friday at 4,023.89. The index gained +2.39% from Thursday and was down -2.44% from last week. The index is up +57.06% from the March 23, 2020, bear market low and down -17.52% from the January 3rd all-time high.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice.

This article was written by a professional financial journalist for Davis & Wehrle, LLC and is not intended as legal or investment advice.

©2022 Advisor Products Inc. All Rights Reserved.

More articles

- For Investors, 2022 Is Turning Into A Test

- Is The Economy Brightening? Or Is The Federal Reserve Slamming The Door On Growth

- Financial Economic News In Perspective

- Stocks Closed Lower This Week On Inflation Fears

- The Main Risk To Investors Now Is Federal Reserve Policy

- Service Sector Jobs Are Catching Up

- Stocks Returned +8.3% More Annually Than 90-Day T-Bills In Past 20 Years

- Perspective Amid A Moment Seeming Fraught With Investment Risk

- Two Years After The Pandemic Began

- Turning The Page On A Dark Period In History

- Russia-Ukraine War Erupted And Inflation Worsened But Outlook Drove Stocks Higher For The Week

- Investment Perspective Amid Risks Of Fed Tightening, Covid Variants, And European War

- S&P 500 Lost -1.9% Friday; Latest U.S. Economic Data Are Strong

- January Job Formation Figures Crushed Expectations, Amid A Shortage Of Workers

- S&P 500 Closed Up 2.4% Friday After A -10% Correction

More

Market Snapshot

|

|

||

|