Why Stocks Shrugged Off Iran Escalation

Published Friday, January 3, 2020 at: 7:00 AM EST

As the U.S. Government was reportedly sending additional troops to the Mideast, after killing a top Iranian leader, fear of Iran's asymmetric warfare tactics spread. The Standard & Poor's 500 stock index closed slightly lower than yesterday's 3,257.85 all-time high, ending on Friday at 3,234.85.

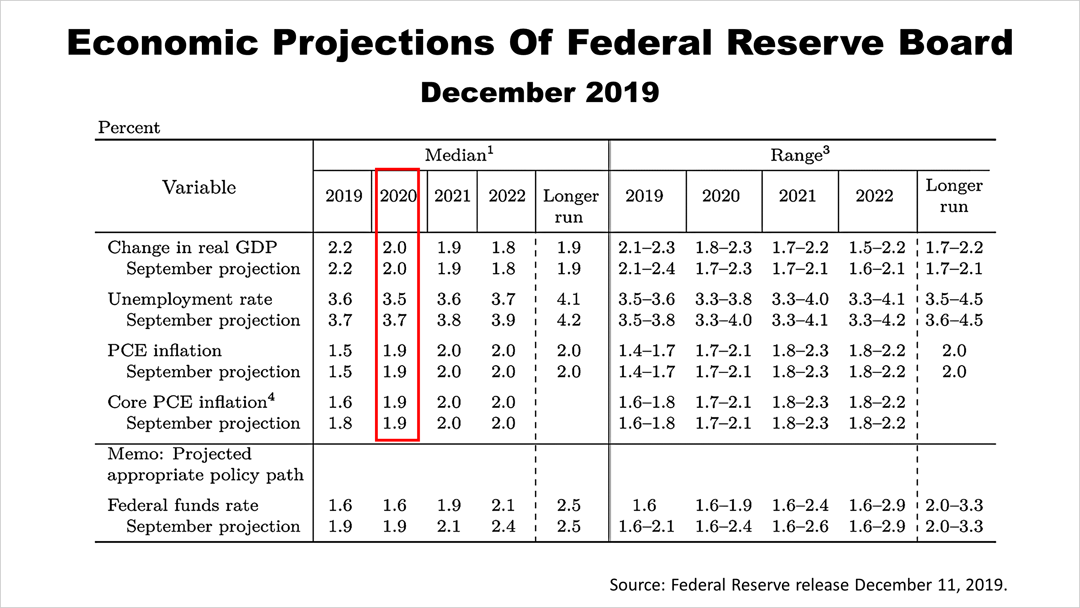

Here's why: The U.S. economy is expected to grow 2% after inflation in 2020.

That's not roaring growth, but the Fed's projections as of December 11th, 2019 were realistic and make it likely that the 10½-year old expansion will continue despite the new foreign crisis.

Although a war with Iran would present serious new risks, not to mention ethical questions, the evidence shows that the U.S. consumer's behavior is not much affected by foreign conflicts.

The U.S.-China trade war did not prevent the stock market from rising nearly 30% in 2019. Brexit did not stop the bull market. The bull market kept right on going.

The U.S. is exceptional among world economies because the consumer population makes 75% of U.S. gross domestic product and they keep growing in wealth by objective standards — despite foreign crises, politics, and ephemeral distractions.

This article was written by a veteran financial journalist based on data compiled and analyzed by independent economist, Fritz Meyer. While these are sources we believe to be reliable, the information is not intended to be used as financial or tax advice without consulting a professional about your personal situation. Tax laws are subject to change. Indices are unmanaged and not available for direct investment. Investments with higher return potential carry greater risk for loss. No one can predict the future of the stock market or any investment, and past performance is never a guarantee of your future results.

This article was written by a professional financial journalist for Davis & Wehrle, LLC and is not intended as legal or investment advice.

© 2024 Advisor Products Inc. All Rights Reserved.

More articles

- A Spectacular Year For Stocks

- A Case For A Bull Market In 2020

- Good Economic News Again

- An Unusual Constellation Of Economic Surprises

- Longest U.S. Expansion Keeps Rolling

- Retirement Income Reality Check

- Find The Major Economic Trend Hidden In This Picture

- Is The New Record High In Stocks Irrational?

- Stocks Break New Record; Economic Outlook Clears

- Despite Frights, Can The Expansion Continue?

- Retail Sales Coverage Reflected The Narrow View Of The Media

- Small-Business Optimism Declines But Remains High

- Analysis Of New Employment, Manufacturing & Service Economy Data

- Quarter Ends Well Despite Trade War, Inverted Yield Curve & Political Crisis

- No Recession But A Slower Pace Of Growth

More

Market Snapshot

|

|

||

|