Amid Record Stock Prices, Fed Policy Is A Risk

Published Friday, July 5, 2019 at: 7:00 AM EDT

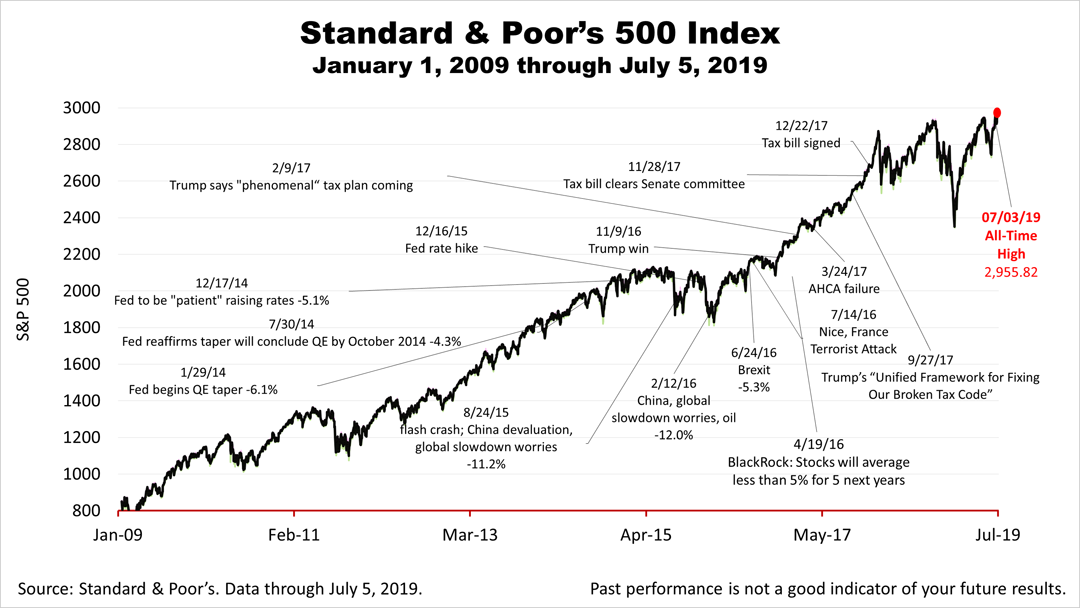

Stocks closed at an all-time high again on Friday and the latest economic data — though it shows growth is slowing — indicates no recession is on the horizon. The Federal Reserve Board's inflation policy is perhaps the biggest risk to the 10-year old expansion.

Today's jobs report was much stronger than expected. Unemployment remained at a low in June last seen a half century ago. The latest monthly survey of 60 economists polled by The Wall Street Journal showed that the professionals are not expecting a recession. The monthly surveys of purchasing managers at manufacturing as well as non-manufacturing companies reported less robust business conditions but continued growth.

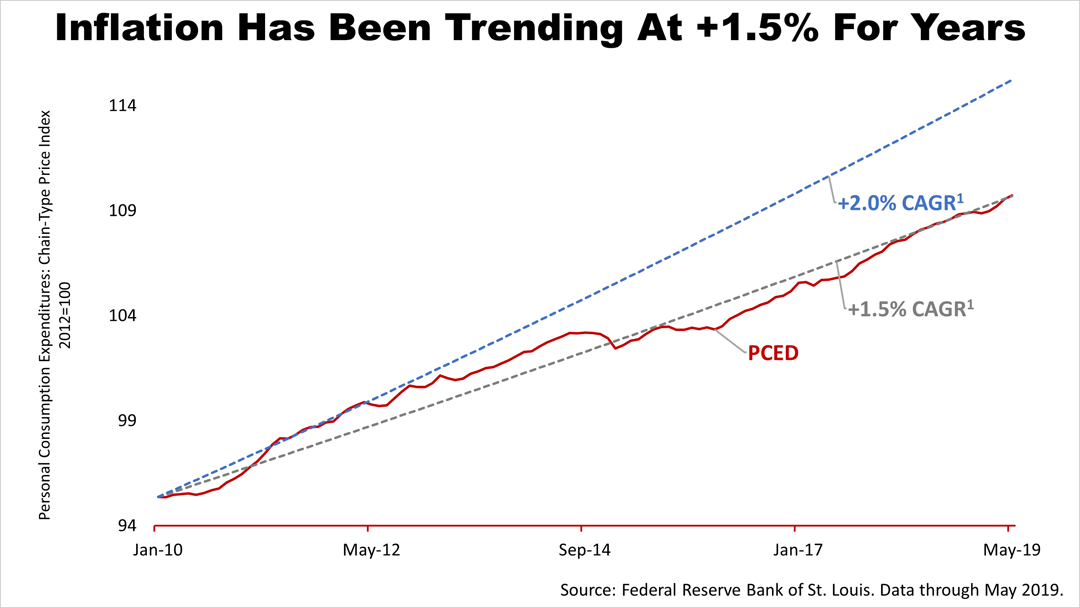

However, the Federal Reserve Board's June 19th economic forecast was unrelenting in its forecast for inflation of 2%. This chart compiled by independent economist Fritz Meyer, which we license, shows a 2% compound annual growth rate of inflation trendline in blue, which is what the Fed has been calling for nine years. The Fed's forecast for 2% inflation was correct in 2011 and 2012 but has been off year after year since 2013. The actual inflation rate has been much closer to 1.5% for five years and the Fed's June 19th policy statement continued to insist that this is transitory. On December 19th, 2018, when the Fed raised rates and tightened credit based on its inflation model, it caused a flash bear market in stocks, chilled holiday retail sales, and caused jitters about the future of the expansion. Since all recessions since 1954 were caused by a Fed mistake, the Fed's inflation policy will be key to a continued expansion.

After breaking its record all-time closing high on Wednesday of 2,995.82, the Standard & Poor's 500 stock index closed fractionally lower on Friday at 2,990.41.

This article was written by a veteran financial journalist based on data compiled and analyzed by independent economist, Fritz Meyer. While these are sources we believe to be reliable, the information is not intended to be used as financial or tax advice without consulting a professional about your personal situation. Tax laws are subject to change. Indices are unmanaged and not available for direct investment. Investments with higher return potential carry greater risk for loss. No one can predict the future of the stock market or any investment, and past performance is never a guarantee of your future results.

This article was written by a professional financial journalist for Davis & Wehrle, LLC and is not intended as legal or investment advice.

© 2024 Advisor Products Inc. All Rights Reserved.

More articles

- Uncle Sam Delivers A Strong Economy

- A Dramatic Pause, As Expansion Breaks Longevity Record

- The Explosion In Real Retail Sales You Never Hear About

- Amid Signs Of Weakness, Fed Reverses Course; Stocks Rally

- Three Stories Affecting Your Wealth This Week

- Buried In The Fed's Financial Stability Report, A Potential Risk To Investors

- Forget Everything You Know About Inflation

- China Trade War Sparks Fear But Not Stock Losses

- Surprisingly Good Productivity, Jobs, Inflation And Trade News

- Stocks Break Record High On Economic Surprises

- U.S. Leading Indicators, Retail Sales, And Atlanta Fed Forecast Signal Strength

- S&P 500 Closes Near Record High Amid Growing Ebullience

- An Early Indication The Economy Is Stronger Than Expected

- A Spectacular Quarter For U.S. Stocks Just Ended

- Real Economy Strengthens, Yield Curve Inverts And Mueller Report Drops

More

Market Snapshot

|

|

||

|